© 2025 CommerceIQ All rights reserved.

QUARTERLY INDUSTRY REPORT

The state of ecommerce: Q1 2025

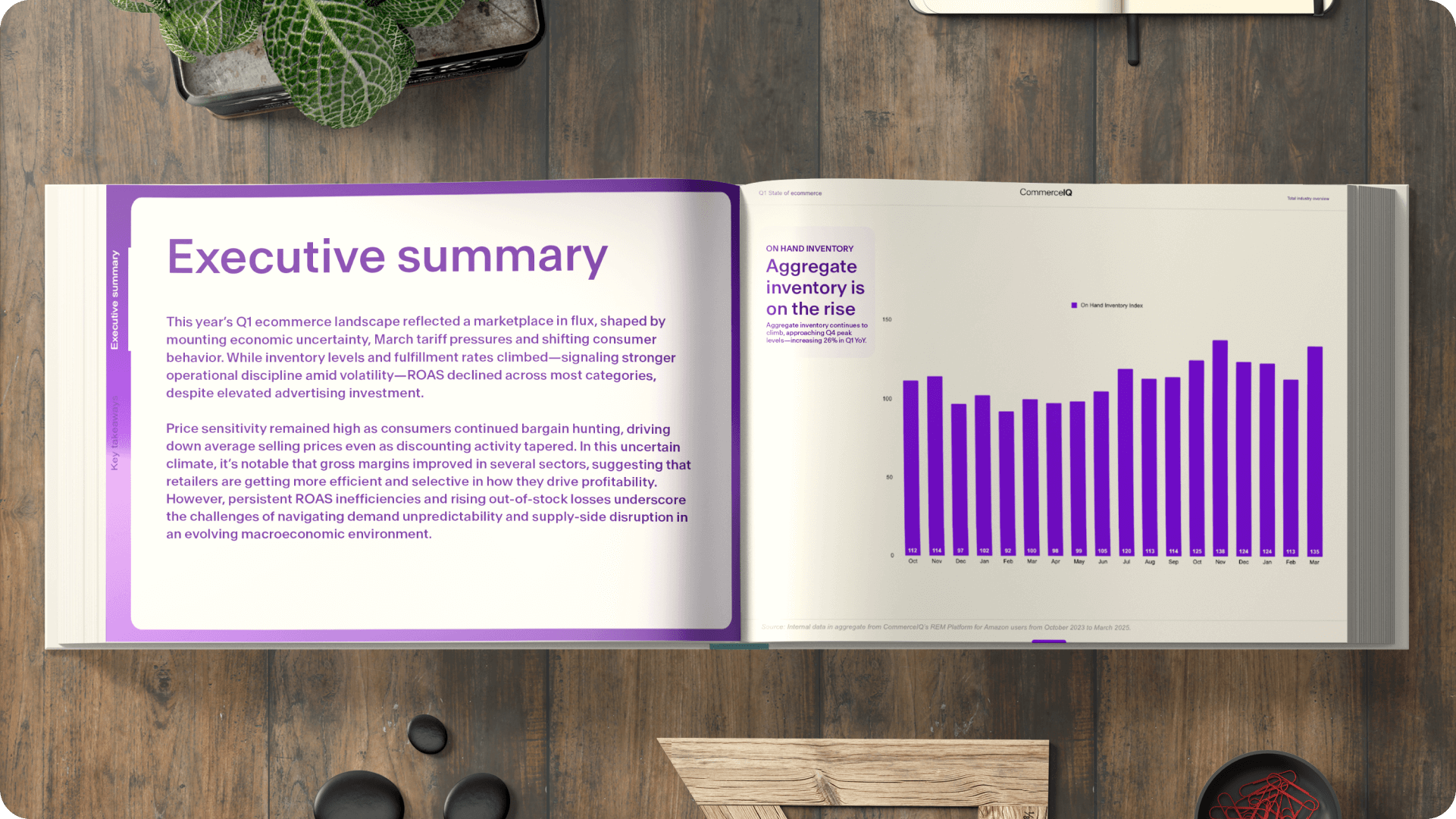

This year’s Q1 ecommerce landscape reflected a marketplace in flux, shaped by mounting economic uncertainty, March tariff pressures and shifting consumer behavior. While inventory levels and fulfillment rates climbed—signaling stronger operational discipline amid volatility—ROAS declined across most categories, despite elevated advertising investment.

Price sensitivity remained high as consumers continued bargain hunting, driving down average selling prices even as discounting activity tapered. In this uncertain climate, it’s notable that gross margins improved in several sectors, suggesting that retailers are getting more efficient and selective in how they drive profitability. However, persistent ROAS inefficiencies and rising out-of-stock losses underscore the challenges of navigating demand unpredictability and supply-side disruption in an evolving macroeconomic environment.

Download the report

Key takeaways

Inventory growth

On-hand inventory increased 26% YoY across the board, nearing Q4 levels—a potential hedge against supply chain volatility.

Fulfillment gains

PO fill rates & order volumes improved YoY, indicating vendor adaptation to Amazon’s systems.

Stable traffic

Glance views remained mostly flat YoY, signaling steady demand with no dramatic shifts in shopper behavior.

Falling prices

Prices trended downward YoY as shoppers sought value, although discounting levels are stabilizing.

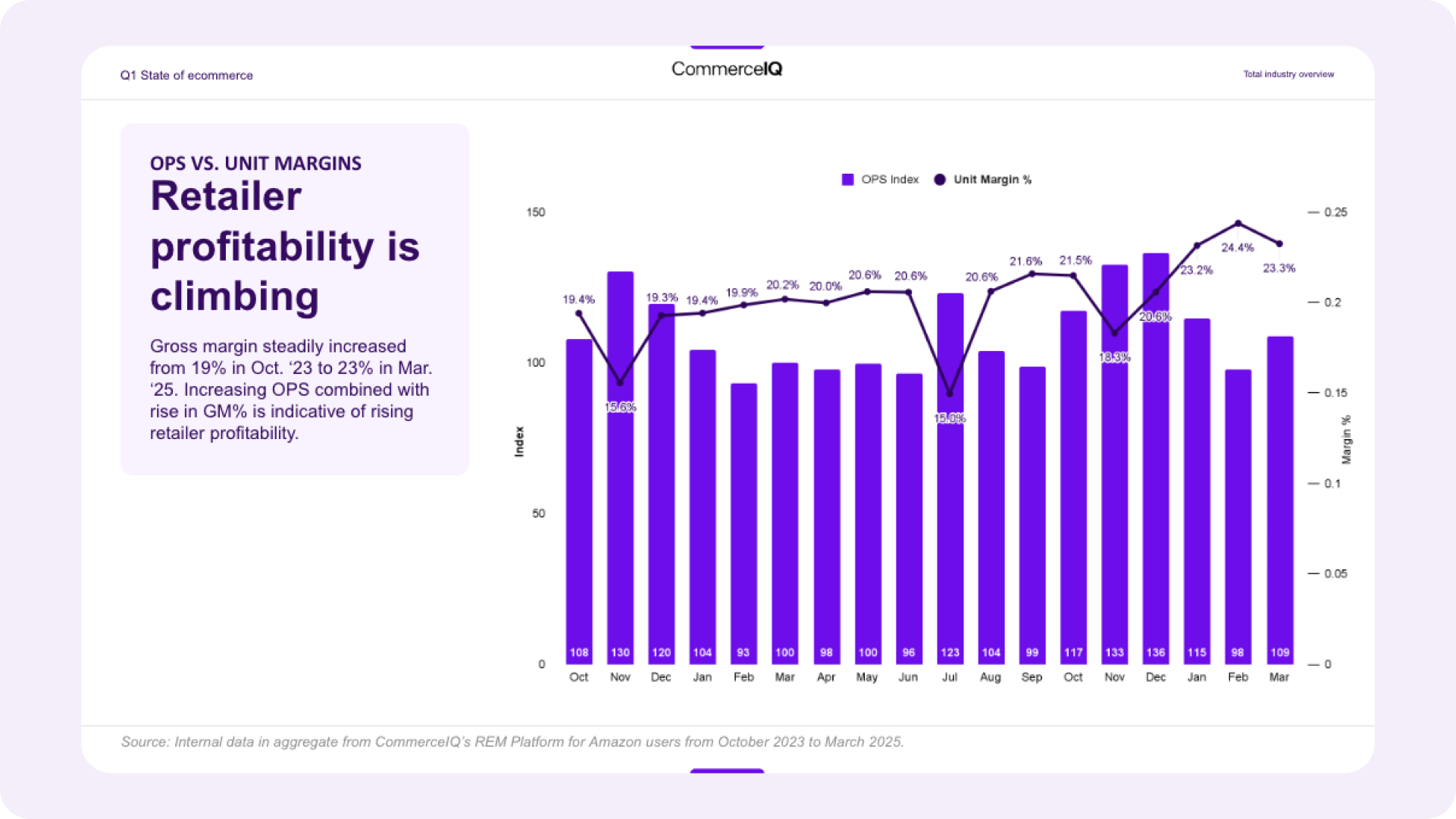

Rising profitability

Gross margins rose to 23% in March 2025 (up from 19% in Oct. 2023), driven by better operational efficiency & selective discounting.

ROAS challenges

Despite rising ad spend, ROAS declined—likely due to higher CPCs and less efficient conversions.